Tokenization of real estate refers to the process of dividing ownership of a property into digital tokens, which can then be bought and sold on a blockchain platform. This process allows for fractional ownership of real estate, allowing investors to buy and sell smaller portions of a property rather than having to purchase the entire property outright. In this article, we will dig down into the process of tokenizing real estate and platforms that are leading the charge in this growing space.

Contents

- What is the Size of the Global Real Estate Market

- Benefits of Tokenization for Real Estate Investors

- Introducing Blocksquare: A Leading Platform for Real Estate Tokenization

- What is Oceanpoint?

- How Blocksquare’s Smart Contracts Benefit Real Estate Transactions

- Asset Management Tools on the Blocksquare Platform

- Final Thoughts: The Future of Real Estate Tokenization

What is the Size of the Global Real Estate Market

The amount invested annually in commercial and real estate can vary significantly depending on various factors such as the location, type of property, and the investor financial resources.

Additionally, the amount invested in commercial and real estate can also be affected by economic conditions and market trends.

In 2019, JLL reported the data as below:

In general, commercial and real estate investment can be a significant source of capital for businesses and individuals.

Some common ways to invest in commercial and real estate include purchasing property for rental purposes, purchasing shares in a real estate investment trust (REIT), or investing in real estate crowdfunding platforms.

Tokenization of real estate is poised to grow the real estate investments significantly in the digital age.

Benefits of Tokenization for Real Estate Investors

One of the main benefits of tokenization is that it allows for increased liquidity of real estate assets.

Traditional real estate investing can be quite illiquid, as it can take a long time to sell a property and there may not always be a ready market for it.

Tokenization allows for more frequent and easier buying and selling of small portions of a property (or its revenue), making it more liquid and potentially more attractive to investors.

By allowing for fractional ownership, tokenization allows individuals to invest in real estate with smaller amounts of capital, potentially opening up the market to a new group of investors who may not have had the means to participate before.

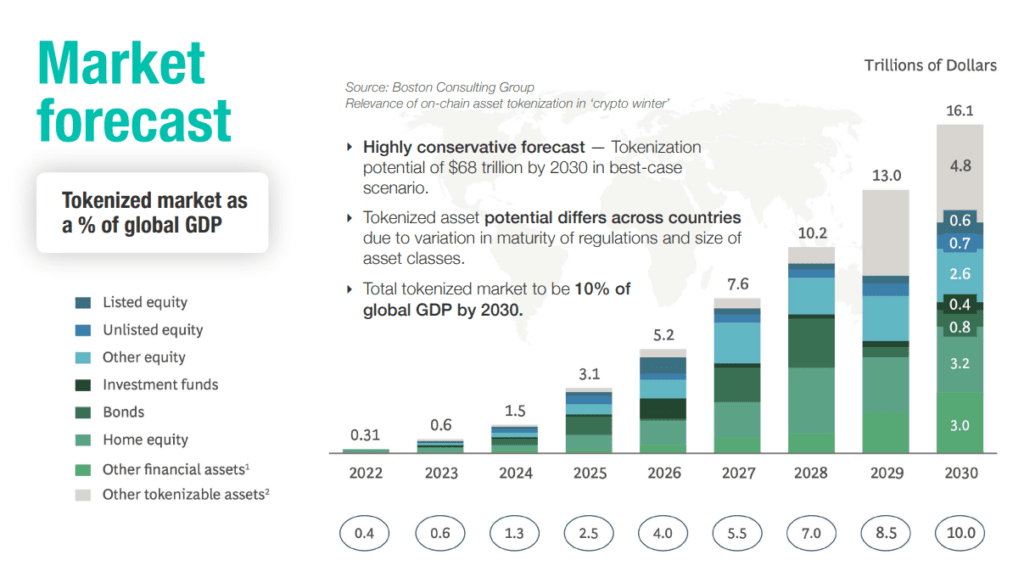

In fact, the forecast for future on-chain tokenization of real estate makes for eye-watering reading:

By using blockchain technology, all transactions and ownership records are securely recorded and publicly available, allowing for greater transparency and reducing the potential for fraud or deceit.

Introducing Blocksquare: A Leading Platform for Real Estate Tokenization

One company that is actively working on tokenization of real estate is Blocksquare.

Based in Slovenia, Blocksquare is a real estate tokenization platform that allows for the creation and management of tokenized real estate assets.

Using the Blocksquare platform, real estate developers and owners can create digital tokens that represent ownership of a specific property or portion of a property.

These tokens can then be bought and sold on the platform by investors using the DeFi arm of Blocksqaure called Oceanpoint.

What is Oceanpoint?

Oceanpoint is a comprehensive DeFi protocol governed by the BST token (the native token of the Blocksquare ecosystem).

As the protocol connecting real estate assets with DeFi, it is designed for ease-of-use, longevity, and scale.

Oceanpoint’s main purpose is to grow the Total Value Locked (TVL) in decentralized finance by adding liquidity to the real estate market, incentivising both sides.

Developed and powered by Blocksquare, Oceanpoint is a set of smart contracts on Ethereum that form an open-end DAO designed to potentially own an unlimited pool of real estate assets, where anyone can participate without legal restrictions to earn by contributing to a decentralized protocol backed by the real estate economy.

How Blocksquare’s Smart Contracts Benefit Real Estate Transactions

One of the main features of the Blocksquare platform is its use of smart contracts. These are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code.

Built on Ethereum and IPFS, any single real estate property can be converted into 100,000 tokens, either partially or in full, providing investors a transparent and standardized digitalization process.

The use of smart contracts allows for automated and secure execution of transactions, reducing the potential for errors or fraud.

Asset Management Tools on the Blocksquare Platform

In addition to facilitating the buying and selling of tokenized real estate assets, the Blocksquare platform also offers asset management tools for property owners.

This includes features such as the ability to track and manage rental payments, as well as tools for maintaining and updating property information.

Also, for ambitious companies around the world, Blocksquare makes investing in real estate assets as simple, borderless, and programmable as the rest of the internet.

Final Thoughts: The Future of Real Estate Tokenization

The tokenization of real estate has the potential to revolutionize the way that real estate is bought and sold, making it more accessible, liquid, and transparent. Companies like Blocksquare are at the forefront of this movement, offering platforms that make it easy for developers and owners to create and manage tokenized real estate assets, and for investors to buy and sell these assets.

If you liked this post on the tokenization of real estate, then feel free to check out some of our other popular posts: