DeFi or “decentralized finance” is a term for financial services on public blockchains. In particular, the Ethereum blockchain has witnessed a high growth of DeFi platforms and applications ushering in a new era of web3.

With DeFi, you can carry out most functions that a traditional bank can offer to its customers such as — borrow, earn interest, buy, lend, trade and more.

With DeFi however there is no third party; it’s global, peer-to-peer, pseudonymous, and open to all.

In this post, we’ll dig down into why DeFi is important, what are the benefits of DeFi, and how this is being applied in the real estate sector through a case study on Blocksquare, a leading European DeFi real estate company.

Contents

Why DeFi is Important?

Taking the premise of Bitcoin or digital money, DeFi expands this and creates an entire digital alternative to traditional the financial system.

This alternative is free from the costs associated with traditional systems that are built on physical infrastructure such as office space. This freedom from the structural hegemony of traditional finance creates a more fair ecosystem that is accessible to anyone with an internet connection.

A digital alternative to Wall Street is a possibility through DeFi.

What are the Benefits of DeFi?

- Open: You don’t need to visit your bank manager or apply online. You can create a digital wallet in minutes

- Pseudonymous: Often, you don’t need to provide personal details

- Flexible: You control your own assets and can move them at a fraction of the cost of fees in traditional finance

- Fast: Wall Street is slow; DeFi is fast often updating in real time

How Does DeFi Work in Real Estate?

The tokenization of real estate will be revolutionized by DeFi in several ways.

In 2020, $690 million worth of real estate was tokenized. According to a report published by Cointelegraph, in 2022 that number grew to over $20 billion.

Tokenization is changing how we invest in real estate. Taking us from a world where a property is transacted once a decade, to a new reality where hundreds of transactions of that same real estate asset are executed within the minute.

This process is powered by DeFi smart contracts allowing for the tokenization of assets.

Tokenization is like holding a share of a company. Tokens can represent fractional ownership of any asset.

This allows anyone with an internet connection to become an investor in real estate. Investors are able to purchase fractional ownership through a website and have their interests transparently recorded on a blockchain.

Individual investors can now participate in large scale developments which historically have been impossible to access.

Enter Blocksquare

Blocksquare is one such company who are looking to lead the vanguard on the tokenization of property.

Blocksquare’s solutions and APIs digitize the value of real estate properties, launch their investment platforms, and connect investors to tokenized real estate opportunities online.

At a fraction of the cost, businesses can start digitizing real estate assets. Built on the Ethereum blockchain and InterPlanetary File System (IPFS), any real estate property can be converted into tokens.

Token batch size is 100,000 tokens (either partially or in full) and provides investors with a digitalization process that is both transparent and standardized.

For leading-edge companies around the globe, Blocksquare makes real estate investments borderless, simple and programmable.

How Blocksquare Tokenizes Real Estate

A problem with tokenizing real estate is met when an attempt is made to either tokenize debt or equity of the capital stack.

Debt is already serviced very well traditionally, while equity tokens have no real on-chain settlement in most jurisdictions around the world.

Therefore in DeFi real estate you need to look at the tokenization of revenue. It is fairly easy to estimate the revenue a particular property can generate.

The most common revenue streams for real estate properties are:

- cash flows from lease contracts, and

- sale of the property to a 3rd party buyer

In terms of commercial real estate, the revenues a property generates also highly impact the valuation of the property as investors look predominantly for a target return.

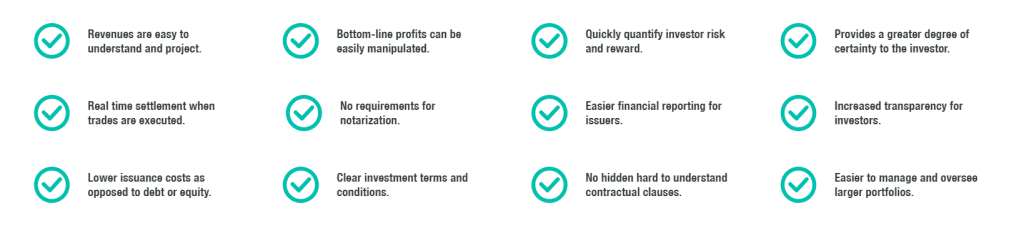

The benefits of revenue investing can be considerable as seen below:

Blocksquare (BST) and Oceanpoint

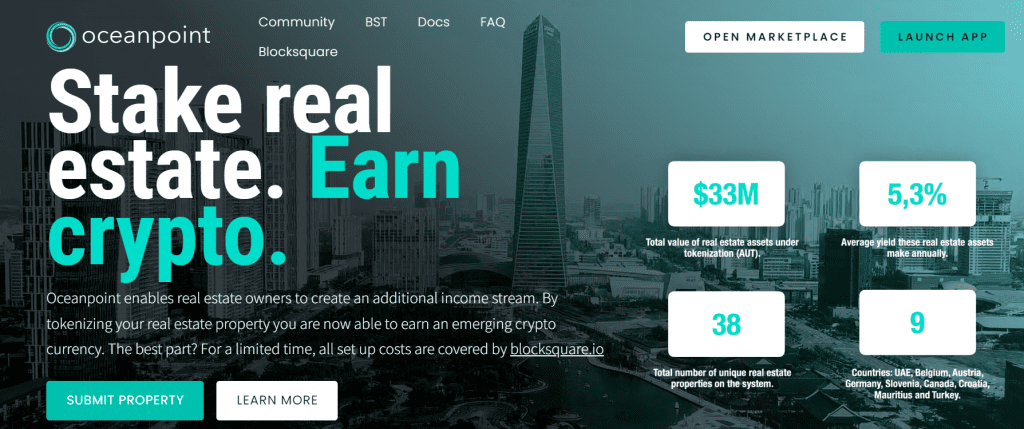

To dig deeper into DeFi and real estate we can look at how and why Blocksquare power the DeFi application, Oceanpoint.

Oceanpoint is a protocol connecting DeFi to real estate assets through tokenization.

Developed and powered by Blocksquare, Oceanpoint is a set of smart contracts on Ethereum that form an open-end DAO designed to potentially own an unlimited pool of real estate assets, where anyone can participate without legal restrictions to earn by contributing to a decentralized protocol backed by the real estate economy.

Oceanpoint’s main purpose is to grow the Total Value Locked (TVL) in decentralized finance by adding liquidity to the real estate market, incentivising both sides.

Version 0.1 of Oceanpoint was launched at the end of February 2022 and gave BST token holders (native token of the Blocksquare project) the ability to stake their BST in the new governance pool in return for the DAO governance token: sBST.

Oceanpoint rests on three main pillars:

1.Defi products

2.Real estate tokenization

3.Community governance

Oceanpoint features

Features reflecting the cryptocurrency category’s accepted standard and that enable proper interoperability between the Oceanpoint protocol and other Defi protocols.

- Non-Custodial: Assets are deposited to and deployed automatically via smart contracts. Users always maintain 100% ownership of their funds and can retrieve them at any time.

- Permissionless: No signup, whitelisting, account verification, or otherwise is required to participate in the Oceanpoint ecosystem.

- Censorship Resistant: Users can always interact with the smart contracts directly, which fundamentally cannot be taken down or tampered with.

- Fraud Resistant: The qualities listed above position Oceanpoint’s ecosystem to minimize the risk of fraudulent activity typically associated with bordered, custodial, trusted, permissioned, closed source, and censored platforms.

- Simple, Easy-to-use: Oceanpoint’s user interface was designed to be as seamless as possible. One-click deposit and withdrawals plus mechanisms for portfolio tracking and miscellaneous Oceanpoint metrics.

- On Ethereum, ‘Layer 2 Positive’: Oceanpoint is deployed on the base (‘Layer 1’) Ethereum blockchain, where it can interact with existing DeFi protocols for yield farming.

For an in-depth deep dive on Blocksquare and Oceanpoint, check out this excellent resource below:

In the tokenizing infrastructure for real estate, Oceanpoint is at the vanguard of this brave new world.

Wrapping Up

The tokenization of retail estate looks set for significant continued future expansion. Companies such as Blocksquare are well placed to capitalize on this buoyant growth.

To learn more about Blocksquare, please visit the following:

Blocksquare | Tokenization infrastructure for real estate | Website