‘How to invest in cryptocurrency?’ This is the first question that beginners in cryptocurrency ask and by the end of this post, you will have a step by step guide to buying and selling cryptocurrencies safely.

Investing in cryptocurrency is one of the most financially rewarding, and nerve-wracking, experiences to undertake. When the initial steps are taken, it can seem like a foreign land. In this guide, we will provide you with the easy to follow tools for getting started.

This guide will give you answers to questions like:

What is cryptocurrency?

How does cryptocurrency work?

How to invest in cryptocurrency?

How to buy cryptocurrencies?

What’s the best cryptocurrency to buy?

Where can I trade cryptocurrencies?

How do I keep my investments safe?

So strap in and enjoy this guide.

***As a disclaimer, if you decide to sign up to some of the services recommended here (which we use), we may get a small commission.***

Contents

- What is Cryptocurrency?

- How Does Cryptocurrency Work?

- Investing in Cryptocurrencies

- I Want to Invest in Cryptocurrency: is it a Good Idea?

- How do I Buy Cryptocurrencies?

- Buying your First Bitcoin on CoinMetro

- What are the Risks of Investing in Cryptocurrencies?

- What Cryptocurrencies Should I Buy for my Portfolio?

- Different Types of Cryptocurrencies

- Storing Cryptocurrency

- How to Keep Track of Cryptocurrency Prices?

- How to Invest in Cryptocurrency – Wrapped Up

What is Cryptocurrency?

Cryptocurrency is a digital asset that uses cryptography for secure financial transactions. It operates on a decentralized platform, meaning that it is not controlled by any central authority such as a bank or government.

Instead, it relies on a network of computers to verify and record transactions on a public ledger known as the blockchain.

The most well-known cryptocurrency is Bitcoin, but there are thousands of other types of crypto that have been developed since its inception in 2009. Some of the most popular include Ethereum, Litecoin, and Ripple.

How Does Cryptocurrency Work?

Cryptocurrency works through the use of a technology called blockchain.

A blockchain is a decentralized, digital ledger that records all transactions on a network. Each transaction is recorded as a “block,” and these blocks are linked together in a chain, hence the name “blockchain.”

The beauty of the blockchain is that it is transparent and secure. Transactions are recorded in real-time, and all parties involved in the transaction have access to the same information.

Additionally, the blockchain is virtually hack-proof, as it would require a massive amount of computing power to alter the data on the blockchain.

Investing in Cryptocurrencies

Today, there over 6000 altcoins on the market to buy. If it’s not Bitcoin, then it’s called an altcoin. Blockchain is the underlying technology that powers these cryptocurrencies and they can have a wide variety of uses.

For example, Ethereum is based on smart contracts and aims to create a global computer whereas Quant Network is a platform that focuses on interoperability between blockchains.

Investing in cryptocurrency can be both lucrative and risky, in equal measure. Markets can be bearish or bullish.

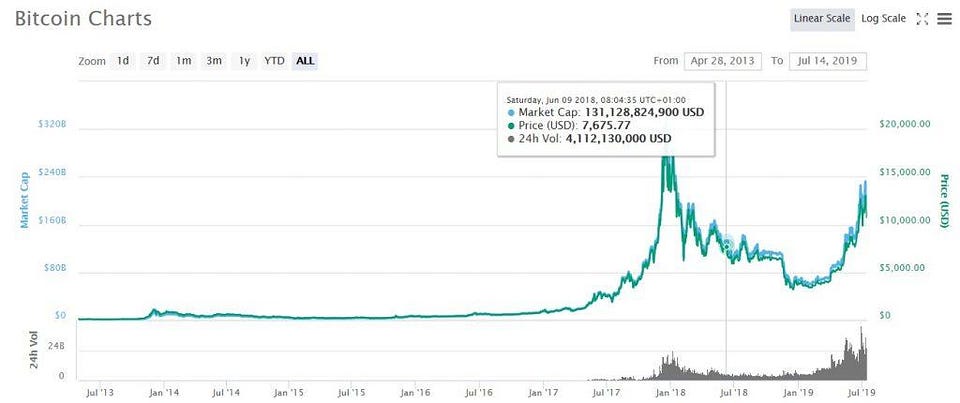

The below chart demonstrates the 2017 bull run which helped many people become wealthy.

Since its inception, Bitcoin rallied from $0.01 to a peak of over 24,000 dollars. During this meteoric rise, Bitcoin has gone through several corrections such as the 2014 bear market and more recently 2018/2019.

While Bitcoin’s direction has been skyrocketing upwards, many altcoins have burst on the scene and subsequently crashed and burned.

At coinesper.com, we’d recommend buying and holding a small basket of well-researched projects that have solid fundamentals and teams. This is one of the safest ways to manage risk. Check out our post on the best ways to diversify your crypto portfolio to learn more.

I Want to Invest in Cryptocurrency: is it a Good Idea?

The most cited reason why people want to get into cryptocurrency investing is the well-documented examples of where people have made crazy sums of money. People often get a sense of Fear of Missing Out (FOMO).

Cryptocurrencies and blockchains have the potential to change the way we interact with the world as we know it. But consider the fact that only a fraction of people is currently involved in the space. Mass adoption has yet to occur.

There are potentially billions of consumers, investors and users coming into the space and that means it’s a great time to get involved.

Another reason why people get involved in Bitcoin is that it serves as a hedge against traditional currencies (otherwise known as fiat currency). The best investors never keep their eggs in one basket. Cryptocurrencies are now becoming increasingly attractive as an option to diversify and give excellent returns.

How do I Buy Cryptocurrencies?

Buying cryptocurrencies has never been simpler. What used to strike fear into the heart of every new investor in the space can now be achieved with ease.

Let’s dig down into how we can get started buying our first cryptocurrency.

We’d always recommend buying actual bitcoin rather than a certificate of bitcoin. You want to be able to own a part of the tech and to be able to send and spend at your leisure.

Buying your First Bitcoin on CoinMetro

Buying bitcoin on the right exchange is simple. We’d recommend starting on CoinMetro. Sign up, verify your identity, submit as a selfie, provide proof of address. You’re now good to go!

This exchange is fully regulated and is super easy for beginners. It has 24/7 online support in case help is needed. Such help is a blessing when you’re starting your crypto investing journey.

This exchange allows you to deposit via SEPA, IBAN, crypto or Visa credit/debit card. You can on-ramp and off-ramp GBP, USD, AUD and EUR.

One thing we like is there’s a demo version of the exchange to try to see if it’s the one for you – try it here.

We have covered CoinMetro previously in a full beginner’s guide and it’s well worth a look CoinMetro Review: Crypto Exchange Guide.

CoinMetro is the best exchange to choose if safety and usability are a priority and you don’t mind submitting ID documents .

What are the Risks of Investing in Cryptocurrencies?

Although there is a lot of scope for making great returns from cryptocurrency investment, the other side of the coin is that the risks of buying and selling crypto are real. You can lose your initial investment.

Let’s explore some of the risk factors.

Volatility

The swings in cryptocurrency prices are more pronounced when compared to traditional markets. This is why margin trading cryptocurrencies can be extra risky. Try to learn and understand the pattern of altcoins before you invest.

Scams

The crypto-verse has been a place where scam projects were rife. When learning how to invest in cryptocurrency, then a good grounding in this area is vital.

For example, dig into the experience of OneCoin. It promised big returns and minimal risk. The business was a pyramid scheme based on smoke and mirrors. Investors were victimised while the others got rich

As regulation and accountability creep in, things are improving. But you still need to exercise caution. We’d always recommend investing in well-known projects and reduce your risk accordingly.

What Cryptocurrencies Should I Buy for my Portfolio?

The following coins are a good starting point to invest in as they are either long-established or high-quality projects. Having a good chunk of your portfolio wrapped up in these will help manage risk.

- Bitcoin (BTC): Bitcoin was the first and is still the most widely-used cryptocurrency. It operates on a decentralized platform and is not controlled by any central authority.

- Ethereum (ETH): Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third-party interference.

- Litecoin (LTC): Litecoin is a cryptocurrency that is similar to Bitcoin, but it has a faster transaction time and a larger supply of coins.

- Ripple (XRP): Ripple is a global payment network that utilizes blockchain technology to facilitate financial transactions.

A smaller proportion of your portfolio should be reserved for more risky altcoin choices where arguably gains and losses can be greater.

Part of the fun and challenge, however, is finding GEM coins before the crowd. This is where due diligence in the form of research comes into play. In any investment space, Do Your Own Research (DYOR) always wins out.

Different Types of Cryptocurrencies

When you conduct your research into which cryptocurrencies to buy, you’ll come across different types of coins.

- Payment Currencies — coins used for payments Bitcoin (BTC), Litecoin (LTC)

- Blockchain Economies — platforms that take functionality further than payments. Some Blockchain Economies you may have heard of include Ethereum (ETH), EOS (EOS), NEO (NEO), and Tron (TRX)

- Privacy Coins — Some digital assets are created with a focus on privacy. Crypto assets like ZCash (ZEC), Monero (XMR), PIVX (PIVX), and so on are examples of Privacy Coins.

- Utility Tokens — Utility tokens are digital tokens that are used for a blockchain-based product or service. Examples include Basic Attention Token (BAT), OmiseGo (OMG) and 0x (ZRX)

- Stablecoins — coins that hold their value USD Coin (USDC), Paxos (PAX) and Gemini (GUSD)

Storing Cryptocurrency

Once you have purchased cryptocurrency, it is important to store it in a secure location.

This is typically done through the use of a cryptocurrency wallet, which is a digital wallet that holds your digital assets. There are several types of wallets, including hot wallets (which are connected to the internet) and cold wallets (which are offline).

Hot wallets are convenient for everyday use, as they allow you to easily access and manage your cryptocurrency. However, they are more vulnerable to security threats, such as hacking and malware.

Cold wallets, on the other hand, offer a higher level of security, as they are offline and therefore not accessible by hackers. Cold wallets can come in the form of hardware wallets, which are physical devices that store your cryptocurrency, or paper wallets, which are printouts of your private and public keys.

It is important to choose a wallet that is secure and suitable for your needs.

For example, if you are planning to hold a large amount of cryptocurrency for the long-term, a cold wallet may be a better option. On the other hand, if you need to frequently access and manage your cryptocurrency, a hot wallet may be more convenient.

How to Keep Track of Cryptocurrency Prices?

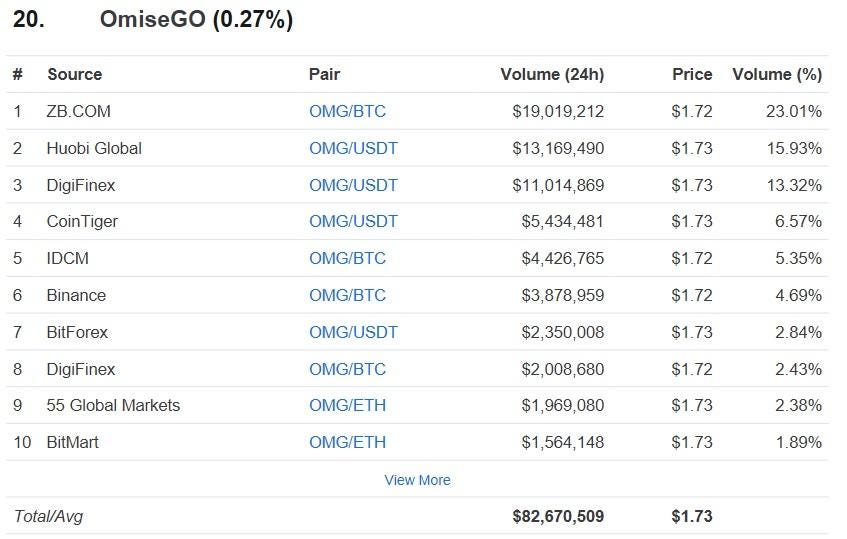

To keep track of cryptocurrency prices your best friend is CoinMarketCap CMC).

CMC is by far the most popular website to check cryptocurrency prices.

CMC enables you to check the prices and market capitalisations of thousands of coins. It also enables you to see on which exchanges the coins are traded and it also provides you with some relevant links about each coin.

Simply go to Coinmarketcap and click on the coin you want to buy.

Next, click on the Markets tab for that coin. Here’s where you can get OmiseGO (OMG). The Source column will show you the exchanges where this coin is being traded.

You will notice how many of them are traded against Bitcoin or Ether.

All you have to do now is find the best exchange on the list and create an account. If you can buy BTC or ETH directly on there, then great.

If not, find the BTC receiving address. Copy it. Log back into Coinbase and send the BTC from here into the exchanges BTC receiving address. Simple!

How to Invest in Cryptocurrency – Wrapped Up

Hopefully, you now know how to invest in cryptocurrency like a boss. You are ahead of the vast majority of people out there!

If you still have any unanswered questions, We’d love to read them in the comments below and feel free to share the page on your favourite social media channels.