How we invest in real estate is being changed by tokenization. Facilitated by the advent of blockchain, people can now tokenize properties, apartments, houses, and digitally represent them on blockchain technology. In particular, for those that are currently priced out of real estate investing, tokenization makes it more affordable to participate. Blocksquare is one company that is seeking to capitalize on this multi-billion marketplace. In this post, we’ll dig down into what tokenizing infrastructure for real estate means and how Blocksquare is positioning itself in this high-growth space.

Contents

What Exactly is Tokenization Infrastructure for Real Estate and Why Does it Matter?

Imagine for a moment you own a property that has a market value of 3 Billion USD. While this valuation certainly makes for eye-watering reading and a wealthy owner, it also presents a problem when you want to sell. A buyer with incredibly deep pockets would be required.

The problem of an illiquid market can be solved through tokenization.

The building owner could tokenize the property with security tokens and issue these tokens like shares. These tokens could then be bought by 1000s or 10’000s of buyers who could freely buy and sell in a marketplace.

Tokenization confers the ability to align available market demand by reaching investors, big or small. Enhanced reach increases liquidity for a wider selection of players in the commercial real estate investment space providing an effective solution to supply and demand.

In turn, the investment space requires robust infrastructure to provide investors the opportunities to engage in this space – in comes Blocksquare.

Blocksquare and Tokenization Infrastructure

From start-ups to large enterprises, businesses can use Blocksquare’s solutions and APIs to digitize the value of real estate properties, launch their investment platforms, and connect investors to tokenized real estate opportunities online.

At a fraction of the cost, businesses can start digitizing real estate assets. Built on the Ethereum blockchain and InterPlanetary File System (IPFS), any real estate property can be converted into tokens.

Token batch size is 100,000 tokens (either partially or in full) and provides investors with a digitalization process that is both transparent and standardized.

For leading-edge companies around the globe, Blocksquare makes real estate investments borderless, simple and programmable.

Blocksquare Leading the Race in Tokenizing Infrastructure for Real Estate

Blocksquare have expansive plans in the tokenizing of real estate. Denis Petrovcic, Chief Executive Officer at Blocksquare, in a YouTube Block-Chats series, noted that Blocksquare will be blockchain agnostic (starting with both Ethereum and Near) targeting businesses and opportunities in what will be a future where only the most agile web3 projects will be able to make the most of market opportunities as the nascent blockchain and retail tokenization space develops.

To gain a insight into Blocksquare’s direction, we highly recommend viewing their in-depth Block-Chats.

Block-Chats explore the rapidly evolving space between blockchain and the tokenization of real estate.

A White Label Marketplace

In addition to the underlying tokenization protocol, Blocksquare has created a white label platform that allows real estate businesses to launch a real estate investment portal in a matter of weeks with no coding.

Businesses can start offering tokenization services to their clients incredibly rapidly.

An out-of-the-box solution for entrepreneurs looking to expand their business online. From invite-only investment clubs to nation-wide investment portals, Blocksquare has is covered.

The white label platform handles investor onboarding including automated Know Your Customer (KYC), the property tokenization process, revenue distribution to token holders, the buying and selling of prop tokens in the form of a secondary market as well as the important aspect of token buyback.

This is usually required when the property is being sold to a third party buyer and the platform gives owners the ability to market and pre-negotiate their offer to holders and manage the entire buyback process.

Blocksquare (BST) and Oceanpoint

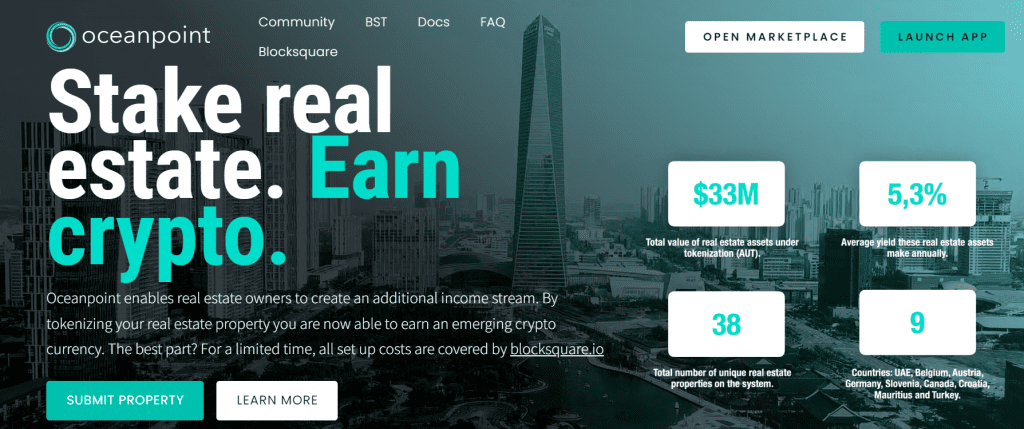

Oceanpoint is a protocol connecting Decentralized Finance (DeFi) to real estate assets through tokenization.

Developed and powered by Blocksquare, Oceanpoint is a set of smart contracts on Ethereum that form an open-end DAO designed to potentially own an unlimited pool of real estate assets, where anyone can participate without legal restrictions to earn by contributing to a decentralized protocol backed by the real estate economy.

Oceanpoint’s main purpose is to grow the Total Value Locked (TVL) in decentralized finance by adding liquidity to the real estate market, incentivising both sides.

Version 0.1 of Oceanpoint was launched at the end of February 2022 and gave BST token holders (native token of the Blocksquare project) the ability to stake their BST in the new governance pool in return for the DAO governance token: sBST.

Oceanpoint rests on three main pillars:

- 1.Defi products

- 2.Real estate tokenization

- 3.Community governance

Oceanpoint features

Features reflecting the cryptocurrency category’s accepted standard and that enable proper interoperability between the Oceanpoint protocol and other Defi protocols.

- Non-Custodial: Assets are deposited to and deployed automatically via smart contracts. Users always maintain 100% ownership of their funds and can retrieve them at any time.

- Permissionless: No signup, whitelisting, account verification, or otherwise is required to participate in the Oceanpoint ecosystem.

- Censorship Resistant: Users can always interact with the smart contracts directly, which fundamentally cannot be taken down or tampered with.

- Fraud Resistant: The qualities listed above position Oceanpoint’s ecosystem to minimize the risk of fraudulent activity typically associated with bordered, custodial, trusted, permissioned, closed source, and censored platforms.

- Simple, Easy-to-use: Oceanpoint’s user interface was designed to be as seamless as possible. One-click deposit and withdrawals plus mechanisms for portfolio tracking and miscellaneous Oceanpoint metrics.

- On Ethereum, ‘Layer 2 Positive’: Oceanpoint is deployed on the base (‘Layer 1’) Ethereum blockchain, where it can interact with existing DeFi protocols for yield farming.

In the tokenizing infrastructure for real estate, Oceanpoint is at the vanguard of this brave new world.

Wrapping Up

The tokenization of retail estate looks set for significant continued future expansion. Companies such as Blocksquare are well placed to capitalize on this buoyant growth.

To learn more about Blocksquare, please visit the following:

Blocksquare | Tokenization infrastructure for real estate | Website